Bitcoin want a parabolic bull run

In a new interview with CNBC’s Crypto Trader, Peter Brandt explains why he’s bullish on the long-term prospects for BTC.

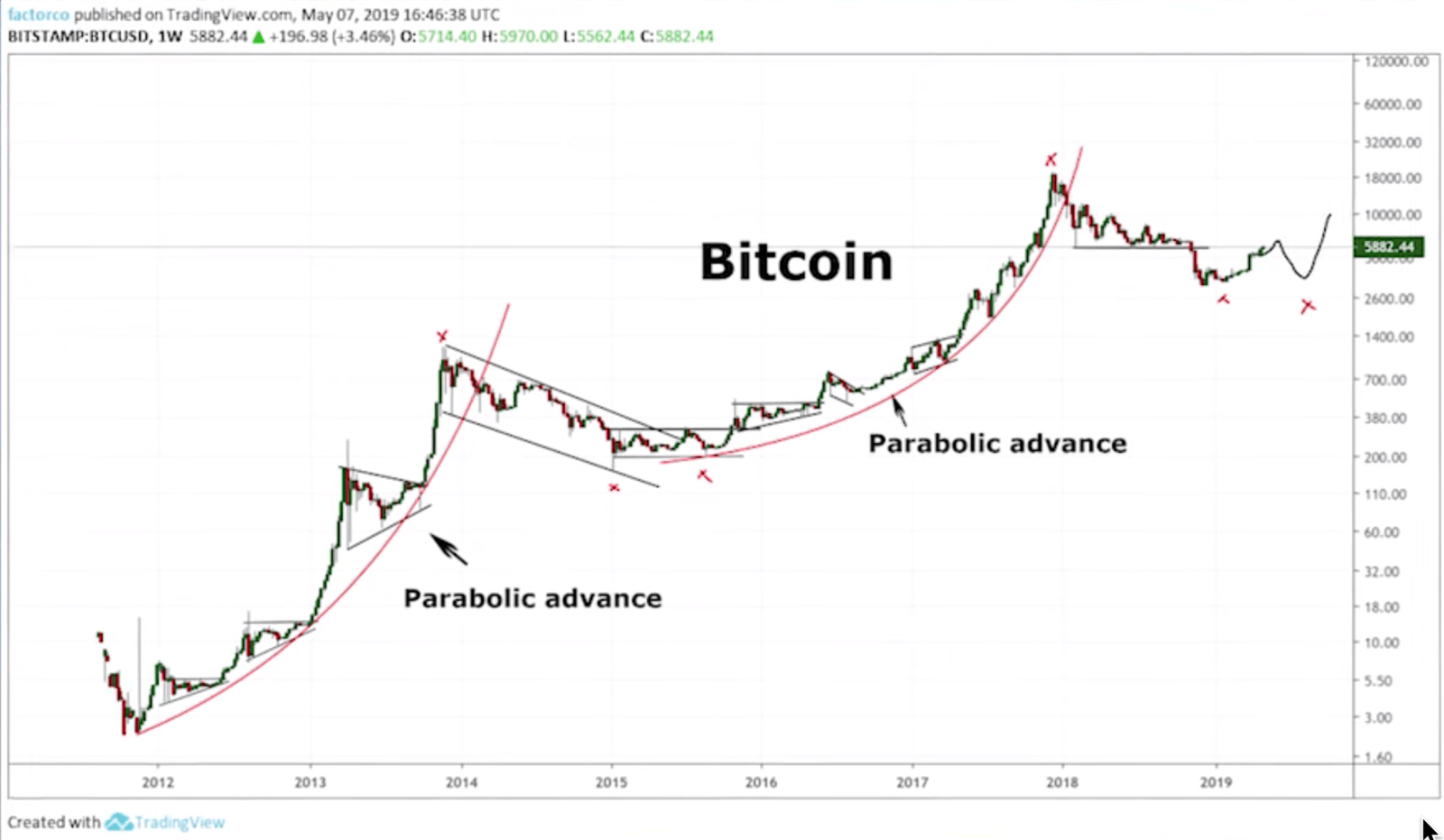

“You have to look really at the long-term chart that goes back to 2011, 2012. And what you’ll see there is a magnificent thing that happened going into the 2013 high. And that was a parabolic move, and it was a parabolic move on a log scale. A parabolic move on a log scale is a magnificent thing. It may only happen once in a decade.

And so we saw that parabolic advance be broken, and then we saw the market from 2013 into 2015 correction. And then it entered another parabolic move. So we have two parabolic moves in the same market. That’s just unheard of. And of course that topped in December of 2017 and we spent 2018 correcting. And I think that there is a chance that we’re going now into the third parabolic move of modern times.

The idea that you look at a market and consider it to be a long-term chart when it’s only a decade long is pretty magnificent. And then if you see the possibility of three parabolic moves in a decades period, that’s unheard of. That, perhaps, has not been seen since we saw German interest rates in the 1920s. So this is unprecedented. So the big question in my mind is are we going into a third parabolic move in Bitcoin, which would be absolutely historic. And for right now, I think the evidence comes down on the side that that is a real possibility.

The moving average that I look at, which is a weekly chart moving average, turned up here about four weeks ago. The last time that moving average turned up was in early 2015 when Bitcoin went from $350 to $19,900, depending on what exchange you’re trading. That is a quantum move, and so we have the same situation as we have seen an upturn in the long-term trend.”

In the short term, Brandt says it’s an open question whether Bitcoin will retrace and test its $3,000 bottom or its recent low around $4,200.