ECB publishes white paper on its own crypto currency

ECB publishes white paper on its own crypto currency

The European Central Bank has published a white paper on its own centralized crypto currency. How Christine Lagarde plans the future of the crypto currency “CBDC” and what is written in the white paper you will find out in this article.

ECB adorns itself with advantages of a crypto currency

At first glance, one might think that it would be a great thing if the ECB would finally venture into digital “new territory”. An open digital block chain without an intermediary and without arbitrary interest rates and inflation? No chance. Unfortunately, the ECB is trying to build a crypto currency based on the old-fashioned model. Although the title of the white paper suggests anonymity in transactions, this is relativized in the course of the text.

Already in the tweet of the ECB, expectations are dampened. There it says that for small transactions privacy should be preserved, but for larger ones a money-laundering check should be carried out. Thus the CBDC is not comparable with a real crypto currency.

The Euro Crypto Currency White Paper

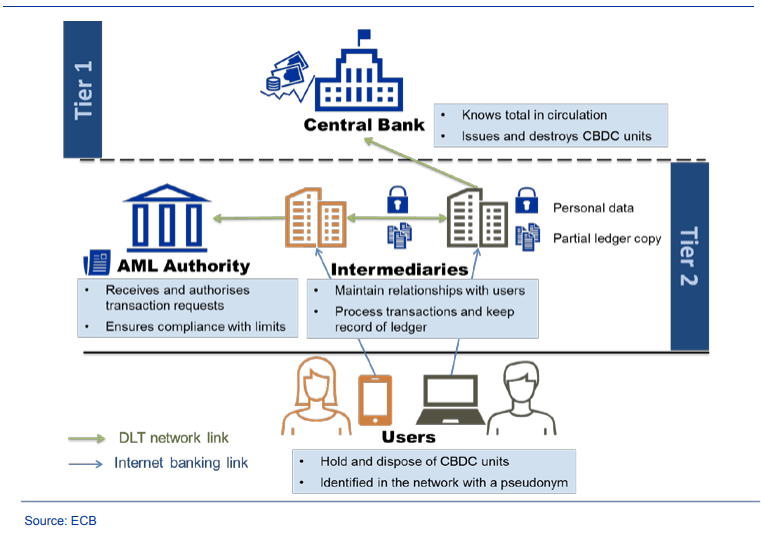

We have analyzed the white paper for you and found some problems directly. With its crypto currency, the ECB wants to reserve the right to arbitrarily increase or decrease the amount of money. ECB institutions have full control over all user data. A padlock here in the graphic feigns a supposedly high level of security.

The users of the alleged crypto currency are also not connected to the block chain in the background. They are merely supplied via a connection to Internet banking. So this has not really much in common with a real crypto currency. In this process, too, there are other intermediaries who are interposed. Decentralization? Nope. As in the existing payment system, the users are thus more like guests than an essential and active part of the network. The ECB and its institutions always retain full control over the network and what happens on it

.

It is important to note that a true cryptocurrency is decentralized, meaning that there is no central authority controlling the network. The blockchain technology that underpins most cryptocurrencies allows for a distributed ledger, where transactions are verified by a network of users rather than a single institution. This ensures transparency, security, and autonomy.

However, the alleged cryptocurrency mentioned in the statement is not truly decentralized. Its users are not connected to the blockchain in the background and are instead supplied via a connection to Internet banking. This means that there are intermediaries involved, and the users are not an essential and active part of the network.

Furthermore, the ECB and its institutions retain full control over the network and what happens on it. This goes against the core principles of a decentralized cryptocurrency, where the power and control are distributed among the users rather than centralized in the hands of a few.

In conclusion, the alleged cryptocurrency mentioned is not a true cryptocurrency in the sense that it is not decentralized and gives full control to the ECB and its institutions. It is merely a digital currency that operates similarly to existing payment systems, with intermediaries and a lack of user autonomy.

.

The ECB’s crypto currency will run on the Corda Blockchain and will be supported by Accenture, one of the world’s largest management and consulting firms. The white paper states that the ECB is the only institution allowed to issue and destroy CBDCs. This means pre-mining and token burning, so to speak. The following diagram explains the process and the flow of transactions in detail:

The ECB’s crypto currency will be known as a Central Bank Digital Currency (CBDC), and will be the only digital currency authorized to be issued and destroyed by the ECB. This means that the process of creating new tokens, or “pre-mining” as it is known in the crypto world, will be strictly controlled by the ECB, as will the process of destroying tokens, or “token burning”.

To help explain the process and flow of transactions involved in the creation, distribution, and use of the ECB’s CBDC, a diagram has been provided in the white paper. This diagram outlines the various steps involved, including how users will be able to access the currency, how transactions will be processed, and how the currency will be stored and managed.

Overall, the launch of the ECB’s CBDC is seen as a significant step forward in the evolution of digital currencies, as it represents a new level of control and oversight by central banks in the creation and management of digital currencies. It remains to be seen how successful this new currency will be, but the partnership with Accenture and the use of the Corda Blockchain suggests that the ECB is taking this initiative very seriously.

CBDC crypto currency as data power and control instrument?

Users of the CBDC crypto currency can register in the network with a pseudonym, but it remains to be seen whether this will be implemented. The ECB will not be deterred from controlling all European monetary transactions. Even if smaller transactions or users should remain anonymous, the ECB will install a backdoor. This will allow the ECB to view user data. A justification for the violation of privacy can always be found.

Users of CBDC may be able to register with a pseudonym, but it’s uncertain. The ECB will still maintain control over all European monetary transactions and plans to install a backdoor to access user data, even if transactions or users are small and anonymous. The ECB can always find a justification for violating privacy.