Bitcoin: A Speculative Attack on the US Dollar

Bitcoin: A Speculative Attack on the US Dollar

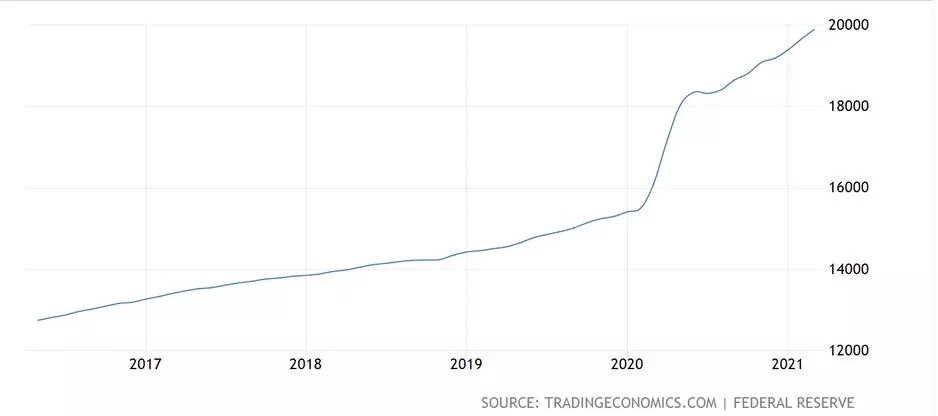

Last week, financial services company Square announced that they were issuing bonds worth two billion. After MicroStrategy issued $650 million worth of convertible bonds in December and increased the sum to 1.55 billion in February, the company bought Bitcoin from this capital. Now hopes are high that Square will also pursue such a plan. What makes it special is that the bonds are priced in US dollars. The debt in US dollars is then used to buy another, better currency. This process is called a speculative attack. This article will explain in more detail how a speculative attack works, the biggest attack that has taken place so far and why Bitcoin can become a special attack.

What is that exactly?

Let’s illustrate the whole thing with an example. We have two countries A and B with their own currency and central bank. If there are now economic fluctuations in country B, the currency is devalued against country A. This leads to the import of products from abroad becoming more and more expensive for country B. This leads to the import of products from abroad becoming more and more expensive for country B. The central bank will now intervene. The central bank will now intervene.

Every central bank in the world has its own foreign exchange holdings with foreign currencies. The central bank of country B will start to sell the foreign currency holdings it owns from country A on the foreign exchange market. Optimally, it will stabilize its own currency by ensuring that the currency of country A is also devalued. This is why, in a fiat money system, central banks are said to compete to see who can devalue the currency first.

But what happens when the central bank of country B has used up its foreign exchange reserves from country A? At this point it becomes interesting for investors and the speculative attack can begin. The investor goes to a bank in country B and borrows, for example, 100 units of country B’s currency. He now converts the borrowed money on the foreign exchange market into 100 units of country A’s currency.

The investor now has to convince other investors to also borrow in currency B and buy currency A. The exchange rate fluctuates. If a sufficiently large number of investors can be found, the exchange rate starts to fluctuate. If the currency of country B depreciates by 50% against country A, the investor can sell his 100 units of country A for 150 units of country B. He pays back his loan with interest and keeps his money. He repays his loan with interest and keeps the remaining profit.

The largest speculative attack in history

Let’s look at the impact a successful speculative attack can have on a country. Before the introduction of the euro, every country in Europe had its own currency. The proposal for a common currency had been on the table for a long time. Many countries still did not want to give up their own currency. The advantages of making their own monetary decisions outweighed the advantages of a common European currency.

The transitional solution was the ERM. This ensured that each country was allowed to keep its own currency, but the exchange rates to each other were fixed. Great Britain did not join the ERM. The then Prime Minister Magarete Thatcher saw the disadvantages for her country and rejected the ERM. When the economic situation in Britain deteriorated in the following years, Thatcher was replaced by the Conservative politician John Major. One of his first acts in office was to announce that Britain would join the ERM.

The UK had already been struggling with economic problems before. But now they could no longer lower interest rates to stimulate the economy. This would have led to a devaluation of the pound. But the exchange rates were now fixed by the ERM. The British central bank felt compelled to buy foreign currency reserves against the pound in order to stabilise the domestic currency. Once the reserves were raised, however, the time had come to launch a speculative attack.

It was the well-known investor George Soros who launched the speculative attack. He borrowed a billion pounds from a British bank and sold it on the currency market against the German mark. Other investors followed Soros. On 17 September 1992, Soros’ position was 10 billion pounds.

The Bank of England descended into chaos. The government announced that it would buy one billion pounds on the currency market. But the purchase had no effect and the government doubled its purchase. This was also too little. In total, the British government bought 27 billion pounds and raised interest rates by 5% in one day. But even this could not further stabilise the British pound.

At the end of the day, the British government announced that it would leave the ERM. It became impossible for Britain to maintain the fixed exchange rate. The pound depreciated 15% against the German mark and 25% against the US dollar. Soros sold his German marks back against British pounds and made a profit of one billion.

The speculative attack with Bitcoin

Bitcoin has properties that make it very interesting for a speculative attack. Soros has used the British pound and the German mark for his attack. Both currencies are inflationary. The idea of carrying out a speculative attack with a currency that has a lower inflation rate than fiat currencies has often been realised with gold in the past. Here, however, gold has failed. Due to the low liquidity of the gold market, a speculative attack is not possible. Bitcoin can be traded 24/7 and is thus one of the most liquid markets of all. Compared to gold, Bitcoin also has a lower inflation rate. Gold has an annual production rate of 2%. Bitcoin, on the other hand, has a rate of 1.8%. The special thing is that Bitcoin’s inflation rate is dynamic. It decreases over time. Bitcoin is therefore better suited for a speculative attack on inflation than gold.

A speculative attack with Bitcoin is very difficult to stop on the part of the central bank. They have no Bitcoin reserves. As described above, the central bank under pressure first sells its foreign currency reserves to stabilise its own currency. Let’s look at the central bank’s dilemma from a game-theoretic perspective. On the one hand, they should buy Bitcoin to be prepared if a speculative attack comes their way. On the other hand, they would weaken their own currency by doing so. For central banks, it makes the most sense to exchange their reserves of foreign currencies for Bitcoin. But if a few central banks start doing this, it can lead to huge conflicts between countries. They start to distrust each other.

One way to avert an ongoing speculative attack is to raise interest rates. Here, however, two problems arise for central banks. First, raising interest rates is very difficult for most countries. Their debt holdings are too high for that. The rising interest burdens would crush them. The second reason is that Bitcoin is an asset class that is unique. With an average annual appreciation of 200% over the past decade, central banks are reaching their limit. For the business of speculative attack to stop being profitable, the interest rate must be raised to 200%. Only then will the cost of the loans exceed the potential profit.

The US dollar enjoyed great prestige worldwide. At first glance, therefore, a speculative attack on the US dollar seems very risky. The central banks of other countries could try to help the US stabilise the dollar. Will they do so? More and more countries are beginning to distrust the US dollar. Many countries, which themselves have difficulties in maintaining a stable exchange rate, pegged their currency to the dollar. If the US dollar loses value, these countries will also suffer. The Corona money glut of the USA in the last 14 months has particularly hurt these countries. It may very well be that if a speculative attack on the USA is launched, these countries will no longer protect the US dollar, but will even support the attack.

Conclusion

The concept of speculative attacks has been around for a long time. States with their central banks are afraid of them. In the case of Great Britain, it could be observed how dangerous a successful speculative attack can become. Only one large investor was enough to get the ball rolling. MicroStrategy is doing just that with their Bitcoin strategy. Governments are probably watching very closely to see what else Michael Saylor plans to do in the future. Jack Dorsey may also be the next to plan a speculative attack on the US dollar with Square. But the American government should not try to prevent this. A speculative attack carried out with Bitcoin cannot be stopped. Especially if other central banks start supporting it. A better strategy has been described by Satoshi Nakamoto:

“It might make sense to get just a few (Bitcoins) in case it catches on. If enough people feel the same way, it becomes a self-fulfilling prophecy.”

Satoshi Nakamoto