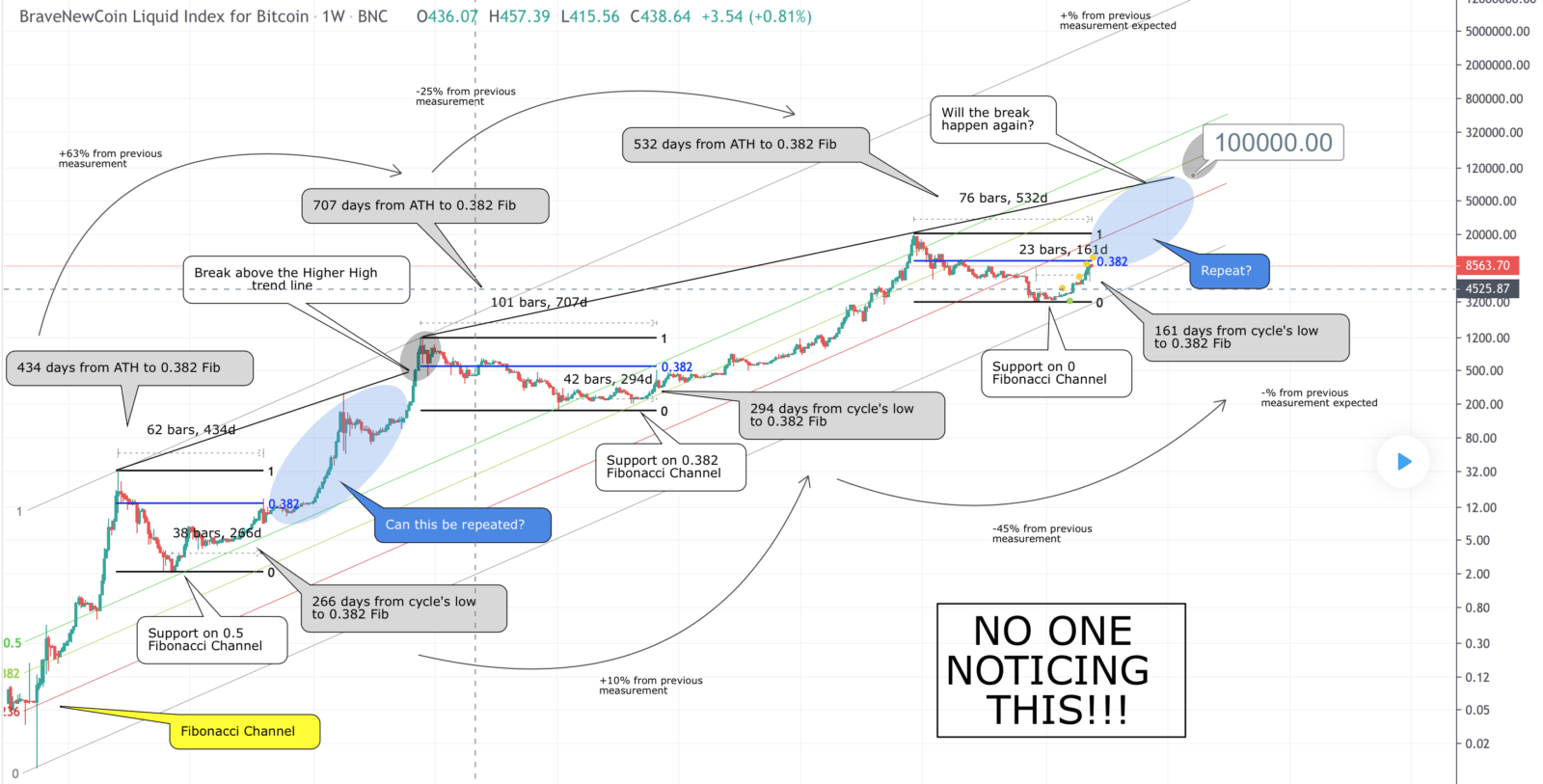

Bitcoin no one is noticing this

BTC shifts bands to $100,000 and no one is noticing the pattern!

Bitcoin no one is noticing this

Bitcoin is now next to making the 0.382 Fibonacci retracement test ( ATH to 3150 bear cycle Low) and one thing has shocked the crypto world more than anything.

The considerably shorter time it has taken BTC to do so compared to the previous two cycles. Few expected such a strong and continuous rebound since the 3150 bottom.

Is this right? Since most researchers though that market cycles take longer within Bitcoin’s parabola, why are we seeing such a strong rise and such a short test of the 0.382 Fibonacci?

Well what I posted 3 months ago regarding BTCUSD’s band shift on the Fibonacci Channel, warning of an upcoming hyper strong bullish sequence while the price was still 3800, is now more relevant than ever:

Well, what I posted 3 months ago regarding BTCUSD’s band shift on the Fibonacci Channel, warning of an upcoming hyper strong bullish sequence while the price was still at 3800, holds even greater relevance at present. The accuracy and foresight of my previous analysis regarding this significant shift in the market trend has become increasingly apparent. As we witness the unfolding events in the cryptocurrency market, it is evident that the predicted bullish sequence has materialized in a manner that surpasses expectations.

The price surge in BTCUSD has been nothing short of extraordinary, following the path set by the Fibonacci Channel. The market has experienced an unprecedented upward trajectory, with Bitcoin’s value soaring to unforeseen heights. It is clear that the band shift identified earlier was a pivotal turning point, serving as a catalyst for this remarkable bullish run.

Throughout this period, the market sentiment has been overwhelmingly positive, with investors and traders alike reaping substantial rewards from this bullish sequence. The surge in Bitcoin’s value has not only exceeded previous records but has also surpassed the projections made by experts and analysts. This serves as a testament to the accuracy and prescience of the Fibonacci Channel analysis conducted several months ago.

Now more than ever, it is crucial to remain attentive to the ongoing developments in the BTCUSD market. As the bullish sequence continues to unfold, it is imperative for traders and investors to adapt their strategies accordingly. While the current market conditions may be highly favorable, it is important to exercise caution and employ appropriate risk management techniques to maximize potential gains and safeguard against unforeseen volatility.

In conclusion, the relevance of my previous warning regarding BTCUSD’s band shift on the Fibonacci Channel has become even more pronounced in light of recent events. The accuracy of the initial analysis and the subsequent realization of a hyper strong bullish sequence have further solidified the credibility of this prediction. As we navigate through this period of unprecedented market growth, it is essential to remain vigilant, adapt to the evolving market conditions, and make informed decisions to capitalize on the potential opportunities that lie ahead.

The author’s previous analysis of BTCUSD’s band shift on the Fibonacci Channel, posted three months ago, is proving to be accurate and relevant. The predicted bullish sequence has materialized in a way that exceeds expectations, with Bitcoin’s value surging to unprecedented heights. The band shift identified earlier served as a turning point and catalyst for this remarkable bullish run. The market sentiment has been overwhelmingly positive, and investors and traders have reaped substantial rewards. The surge in Bitcoin’s value has surpassed previous records and expert projections, confirming the accuracy of the Fibonacci Channel analysis. It is crucial to stay attentive to ongoing developments in the BTCUSD market and adapt strategies accordingly. While current market conditions are favorable, caution and risk management techniques are essential to maximize gains and protect against volatility. The author emphasizes the continued relevance of their previous warning and encourages vigilance, adaptation, and informed decision-making to capitalize on potential opportunities.